Apply for PAN Card

1. Online

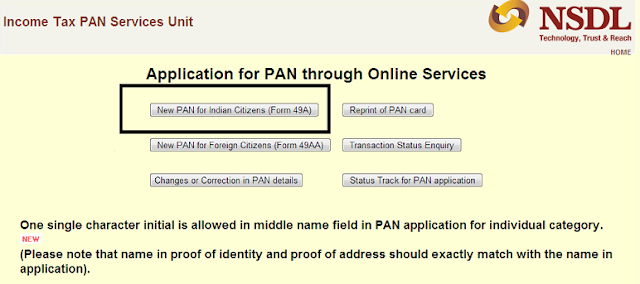

You can apply for PAN

Card online, for this open this link www.tin-nsdl.com and go to Services,

then Click on PAN – Apply Online, and then New PAN.

According to another

method go to www.incometaxindia.gov.in and click on PAN on upper left side.

Follow Apply Online. From there you can fill your PAN

application form by NSDL or UTIITSL. You will just need to pay Rs. 96 through

online banking. CLICK HERE TO KNOW What is Permanent Account Number PAN Card and Why It is Necessary ...

|

| How to Apply for PAN Permanent Account Number Card Online Offline |

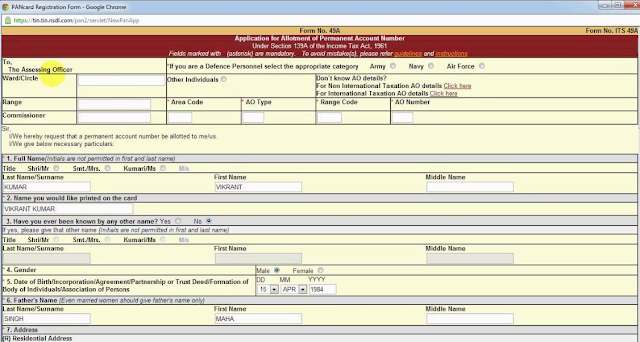

As you completed your

form and payment, take a print out of acknowledgement form, paste your photo

over and attach your other necessary document. Courier or Speed Post these

documents to NSDL or UTIITSL.

Address of NSDL and

UTIITSL :

- NSDL

: Income Tax PAN Services Unit, National Securities Depository Limited,

Third Floor, Safire Chamber, Baner, Pune – 411045.

- UTIITSL

: UTIITSL, Plot No – 3, Sector 11, CBD, Belapur, Navi Mumbai – 400614

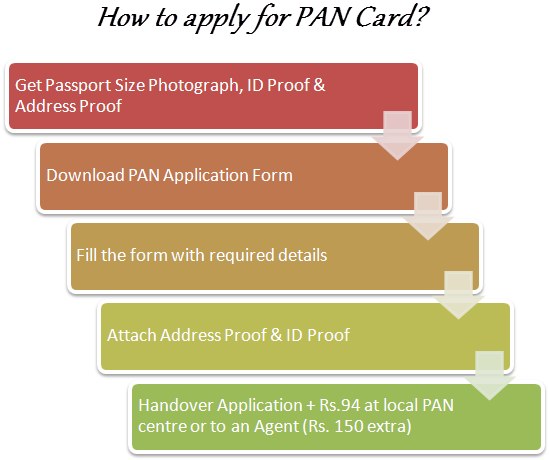

2. Offline

or Through Service Centers :

The Tax Department

authorized UTIITSL ( UTI Infrastructure Technology Services Limited ) to make

PAN Card. They have many branches in many cities to know their nearest branch

to you, and then check on UTIITSL and Income Tax websites or you can go to www.incometaxindia.gov.in.

Their click on application centers from UTIITSL. A page will be open for UTIISL

branches.

After this go to your

nearest branch and fill the form to apply. If you are facing any problem in

filling the form then you can take help from branch employer. Submit the form

and don’t forget to take your receipt.

Which Form I have to

Fill :

Fill form no 49A at PAN

Service Center, it is free for you. You can download the form from income tax

website also and there are some stationary who sell form as well. Remember, use

black ink point pen to fill the form.

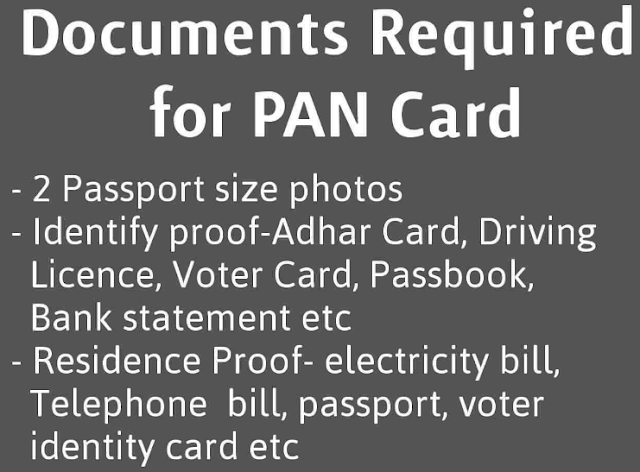

Document Required :

You will need 2 current

colored passport size photos, an ID proof, an Address Proof both must be self

attested. Attach them with application form and submit. CLICK HERE TO KNOW Benefits of Using Permanent Account Number PAN ...

|

| Track Online Status of PAN Card |

List of ID Proof

Documents :

- School

Leaving Certificate

- 10th Provisional

Certificate or Marksheet

- University

Degree

- Passport

- Voting

ID Card

- Driving

License

- Ration

Card

- Parents

/ Guardian Identity Proof

Choose any one of these.

List of Address Proof

Documents :

- Phone

Bill

- Electricity

Bill

- Water

Bill

- Credit

Card Statement

- Bank

Passbook

- Employer

Certificate

- Voting

Card

- Ration

Card

- Rent

Agreement

|

| National Securities Depository Limited |

Choose any one of these,

if you don’t have any of these documents, then contacts to you area MLA, MP or

Gestated Officer, request one of them to write that they know you and you are

living in their area (mention your address ). They will stamp on this acknowledgement

and then you can use this as an address proof.

Fees for the Application

:

You just need to pay Rs.

96 for your application.

When I will Get my PAN

Card :

After the submission of

application form, income tax department sends your PAN Card within 20 days

through Speed Post. But if you don’t receives your PAN within this time period

then, use you 15 digits coupon number to check the online status of your card.

To track the online status of card, go to www.utiitsl.com. Then click on

services, PAN Card, Write your coupon number in slot and click OK.

TO KNOW MORE ABOUT HOW TO

APPLY FOR PAN PERMANENT ACCOUNT NUMBER CARD ONLINE OFFLINE, IMMEDIATELY COMMENT

US BELOW AND GET FAST INSTANT REPLY. THANK YOU.

|

| Document Fee Required to Apply for PAN |

Track Online Status of PAN Card, Address of NSDL and

UTIITSL, National Securities Depository Limited, Application Form for PAN,

Document Fee Required to Apply for PAN, List of Document and Address Proof

YOU MAY ALSO LIKE : -

- How to Do Device Settings in Android Smartphones

- Smart Phones Settings and How to Use them

- Use of More Networks Settings Option in Android Smartphones

- What is Voter Identity Card ID and Its Requirement

- How to Apply for Voting ID Identity Card and Which Form is Required for It

- How to Apply for PAN Permanent Account Number Card Online Offline

- Ramayana Couplets and Quatrains can Remove All Your Problems

- Some Important and Key Features to See or Read Horoscope and Birth Chart

- The Fourth Mars or Forth Place of Mangal Decides Happiness and Misery

- The Story of Happy Navratri Fast and Its Benefits

- Easy Steps to Manage Connection Settings in Smartphone

No comments:

Post a Comment